By Mary Ann Ll. Reyes | November 24, 2010

MANILA, Philippines - Metro Pacific Investments Corp. (MPIC) is prepared to pour in anywhere from $300 million to $700 million for the expansion and improvement of the Metro Rail Transit (MRT) 3 system.

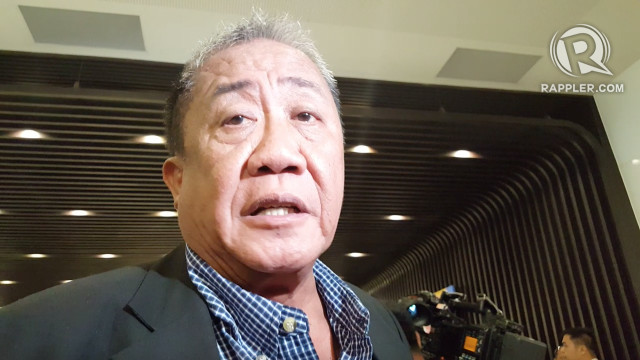

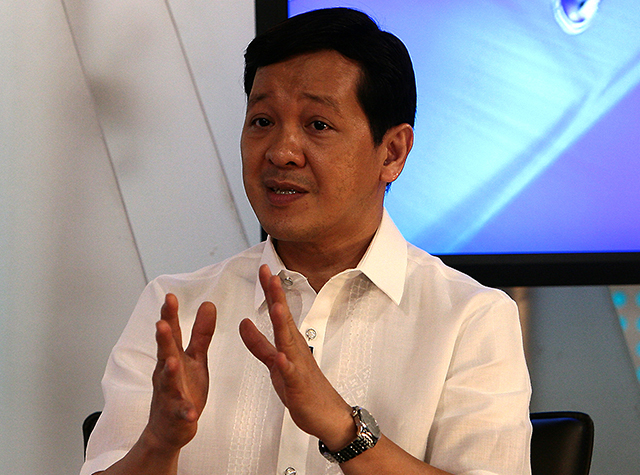

MPIC chairman Manuel Pangilinan said “this just is a desktop analysis of what we can do for MRT 3, for the rolling stock, signalling systems, refurbishments of the platforms, adding more cars, general refurbishments of the tracks.”

He also pointed out that if cars are added to the system, it will need enlarging the platforms, improving the signage and the lightings, and adding more escalators to make it more convenient to the passengers.

MPIC earlier said it wants a substantial stake in the MRT 3 project, even beyond the 29 percent it is set to acquire from Sobrepeña-led Fil-Estate Corp.

MPIC said in a statement that it is the company’s intent to increase its shares in MRT3, subject to the consent of its bondholders. “This plan is still ongoing and a timely disclosure will be made ready for the investing public,” the company informed the Philippine Stock Exchange.

Pangilinan explained that while their group may want to look at acquiring an additional stake in MRT3, it depends on other shareholders if they will allow it. “What is certain for now is that MPIC will buy the 29-percent stake held by Fil-Estate,” he pointed out.

The company earlier entered into an agreement to acquire Fil-Estate’s stake in four MRT 3 companies.

The four companies are Metro Rail Transit Holdings, Inc., Metro Rail Transit II Inc., Metro Rail Transit Corp. (MRTC), as well as in Monumento Rail Transit Corp.

Fil-Estate’s key investment is in the form of equity interest in Metro Rail Transit Holdings, Inc. and Metro Rail Transit Holdings II. Its combined investment in these holding companies represented approximately 29-percent interest in the EDSA MRT systems.

Insiders told The STAR that MPIC and Fil-Estate have been talking for months now about a possible investment in MRT-3. “It is no longer a secret that MPIC has expressed interest in MRT 3 and that Fil-Estate needs money,” one observer noted.

MPIC said it has entered into a cooperation agreement with Fil-Estate relating to the latter’s rights and interests in the four MRT 3 companies.

The transaction involved, among other things, the appointment of new directors in the said MRT 3 companies who will pursue the continuing relationship between MRTC and the Philippine government under the build-lease-transfer (BLT) agreement covering the MRT 3 line along EDSA.

Knowledgeable sources revealed that there has been no agreement yet as to what form the investment by MPIC into the MRT-3 companies will take, but it will definitely end up in MPIC owning part of Fil-Estate’s stake in the said firms.

“Right now, it may just be an assignment of rights or of its shares by Fil-Estate which allowed MPIC to appoint its directors in the four MRT-3 companies. There are still legal matters that need to be threshed out, including what legal vehicle to utilize for the said investment. But at the end of the day, MPIC will be acquiring part of Fil-Estate’s stake,” the source said.

MPIC and Fil-Estate said they entered into this agreement for the promotion of a smooth relationship between the private sector and the Philippine government towards expanding the MRT 3 system along EDSA and to ensure that the vision for an efficient mass transport system along EDSA and the rest of the metropolis, including the linkage to MRT 3 Phase 2, is achieved.

Following this agreement in the MRT 3 companies, MPIC said it will spearhead cooperation efforts with the national government in streamlining the operations of the MRT 3. By providing efficient and reliable operations, it said MRT3 can maximize its potential to deliver convenient mass transportation services to the increasing metropolitan population.

MPIC has also expressed interest in undertaking the operation and management (O&M) of MRT3 as well as that of the Light Rail Transit (LRT) 1 which the government plans to privatize under the public-private partnership (PPP) program.

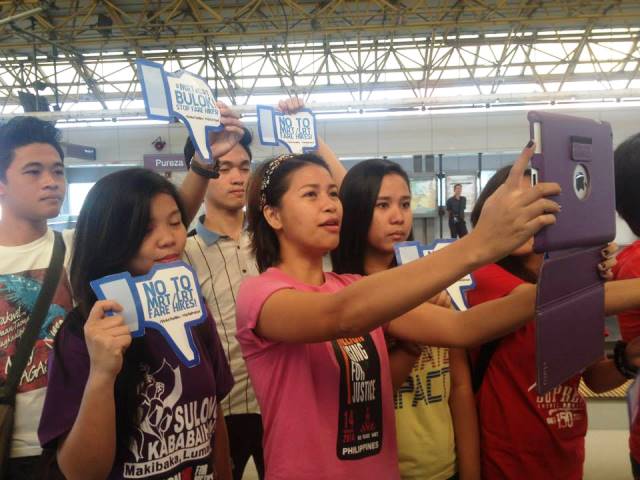

The project, which is included in the list unveiled by the Department of Transportation and Communications (DOTC) as a priority for investing and financing under the Public-Private Partnership (PPP) program, involves the privatization of MRT3’s O&M for a period of three to five years, with the option to integrate LRT1 O&M, prior to privatization, through a concession, including repaid and rehabilitation of rolling stocks.

MPIC has likewise signified its interest in two projects that will involve the expansion the expansion of MRT and LRT.

The first, the MRT/LRT Expansion Program: LRT 1 South extension and privatization through concession, involves the construction of 11.7 km LRT extension, eight stations with provision for an additional two, a satellite depot for light maintenance, intermodal facilities at high demand stations, additional rolling stocks to meet growth in demand, and systems enhancement.

As a private-public partnership, civil works and electromechanical works will be undertaken by government at a cost of $700 million, while the rolling stocks and O&M will be done by a private firm at a cost of $800 million.

The second involves the privatization of the O&M of LRT 1 for a period of 3-5 years, with the option to integrate MRT3 O&M, prior to privatization, through a concession.

Also included in the PPP is the LRT Line 2 East Extension Project which will involve the construction of a four-km eastern extension and two additional passenger stations. Total project cost is $220 million, of which $120 million will be government (civil works and electro-mech) and $100 million private (rolling stock and O&M).

Pangilinan said the extension of MRT and LRT “seems to be interesting because we already have a small stake in MRT3.”

Twitter

Twitter Facebook

Facebook